SOL Price Prediction: Can SOL Hit $200 Amid Bullish Technicals and Institutional Demand?

#SOL

- Technical Breakout: SOL must clear $177 resistance to confirm bullish trend

- Institutional Tailwinds: Record investment and Visa partnership bolster fundamentals

- MACD Divergence: Positive momentum despite price below 20-day MA

SOL Price Prediction

SOL Technical Analysis: Key Indicators to Watch

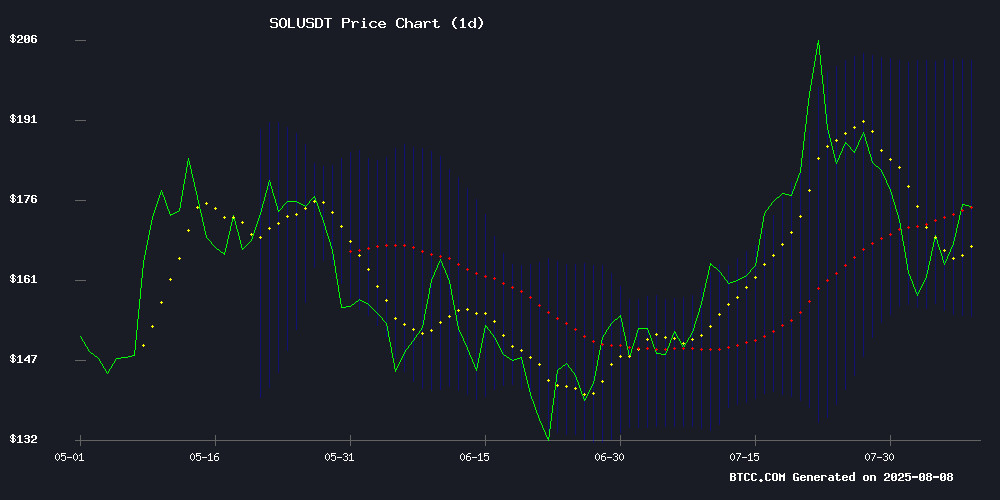

SOL is currently trading at $176.56, slightly below its 20-day moving average (MA) of $178.34, indicating a neutral to slightly bearish short-term trend. The MACD (12,26,9) shows a bullish crossover with the histogram at 7.6875, suggesting upward momentum. Bollinger Bands reveal price hovering NEAR the middle band ($178.34), with upper resistance at $201.99 and lower support at $154.69. According to BTCC financial analyst Robert, 'SOL needs to break above the 20-day MA to confirm a bullish reversal. The MACD supports upside potential, but traders should watch the $177 resistance closely.'

Solana Market Sentiment: Mixed Signals Amid Institutional Growth

Solana's price action faces a critical test at $177 as institutional investment hits record levels. News of Visa's stablecoin expansion boosted SOL by 4.28%, while projects like Pump.fun and Saros crypto highlight Solana's DeFi momentum. However, Hyperliquid's revenue dominance and Uber-inspired warnings about vanity metrics introduce caution. BTCC's Robert notes, 'ETF inflows and TVL growth could propel SOL toward $250 by September, but the $177 breakout must hold first. Institutional interest is a strong fundamental tailwind.'

Factors Influencing SOL's Price

Solana Faces Key Resistance at $177 Amid Mixed Technical Signals

Solana's SOL has rallied approximately 14% since its August 2 low, encountering stiff resistance at the $177 level. The rejection at this psychological barrier comes as short-term stochastic RSI indicators suggest potential exhaustion in buying momentum.

Contradicting the 4-hour chart signals, the daily timeframe paints a more bullish picture. MACD lines show convergence toward a potential bullish crossover, while the recent breakout above a descending trendline remains technically valid. Weekly charts confirm the significance of current resistance levels, though the higher timeframe MACD maintains an upward bias.

Traders appear divided between taking profits at resistance and anticipating continuation patterns. The coming sessions will prove decisive - either confirming the resistance level's strength or demonstrating SOL's capacity to power through technical barriers as seen in previous rallies.

Pump.fun Launches Liquidity Initiative Amid Revenue Decline

Solana-based memecoin launchpad Pump.fun has established the Glass Full Foundation (GFF), a liquidity provision arm designed to support select projects within its ecosystem. The move comes as platform revenues have sharply declined from January's peak of $7 million daily to approximately $200,000 earlier this month.

The foundation will inject liquidity into chosen tokens, with initial deployments already underway. Pump.fun's top ecosystem token, Fartcoin (FART), currently holds a market valuation exceeding $1 billion, followed by peanut the squirrel at $253 million.

This strategic pivot occurs as LetsBonk.fun, a competing Solana launchpad tied to the Bonk community, has gained significant market share, emerging as last month's highest-grossing platform by issuances.

Institutional Investment In Solana Reaches Record Levels

Solana is witnessing an unprecedented influx of institutional capital, reshaping its position in the cryptocurrency landscape. Publicly traded companies have collectively invested nearly $600 million in SOL, according to CoinGecko data. Four firms—Upexi, DeFi Developments Corp, SOL Strategies, and Torrent Capital—now hold over 3.5 million SOL, signaling long-term strategic commitments rather than speculative bets.

The accumulation strategies vary, ranging from rapid purchases to tactical reinforcements and dollar-cost averaging. This institutional endorsement underscores Solana's growing appeal, bolstered by staking yields and confidence in its ecosystem's expansion. The trend reflects broader adoption of digital assets by traditional finance, with Solana emerging as a key player.

CARV Concludes Tech Fairness Hackathon Showcasing AI and Web3 Innovation

CARV, a pioneering AI infrastructure platform for sovereign AI Beings, has successfully wrapped up its Tech Fairness Hackathon in collaboration with FAIR3 and HackQuest. The event attracted over 600 applicants and 200 projects, with 21 teams emerging as winners from 30 finalists. The hackathon highlighted global interest in privacy-first, modular applications—a vision aligned with CARV's roadmap to evolve into a fully composable AI Being Stack.

Participants focused on four core infrastructure layers: AI Agent Infra on SVM, decentralized data orchestration, modular identity systems, and open innovation. Standout projects like AI World and Cipher Protocol demonstrated the potential of decentralized agents. The event underscores Solana's growing role in AI execution layers, though no direct cryptocurrency mentions were made in the provided content.

Solana (SOL) Rises 4.28% on Visa's Stablecoin Settlement Expansion

Solana's SOL surged to $174.33 following Visa's integration of the blockchain for stablecoin settlements, marking a 4.28% gain. The move underscores Solana's growing role in institutional payment infrastructure, with Visa citing its speed and scalability as decisive factors.

Technical indicators remain neutral—RSI at 52.29 suggests balanced momentum—but the announcement has shifted sentiment after a 25% pullback from July's $206 peak. Futures trading volume on CME had already signaled institutional interest, spiking 252% in July to $8.1 billion.

Ecosystem developments like the August 4 launch of Solana's second-generation Seeker smartphone further reinforce real-world adoption beyond DeFi. Market participants now watch whether SOL can consolidate above key support levels amid broader crypto uncertainty.

The Illusion of Vanity Metrics in Crypto: Lessons from Uber's Playbook

Vanity metrics plague both traditional tech and cryptocurrency sectors, creating misleading narratives of success. Uber's early days reveal how topline numbers like total trips or active riders often obscure true growth dynamics. The company focused instead on granular network effects—adjusting driver incentives, marketing budgets, and operational tactics to drive sustainable expansion.

Crypto markets face similar pitfalls. Metrics like "daily active addresses" are particularly deceptive, given the frictionless creation of wallets and rampant airdrop gaming. Solana's recent memecoin launchpad activity exemplifies this challenge, where surface-level engagement metrics may mask speculative froth rather than organic adoption.

Solana Price Prediction: SOL Eyes $250 by September as ETF Inflows and TVL Fuel Breakout Setup

Solana is quietly building momentum across multiple fronts. Total Value Locked (TVL) has reached a 3-year high, while ETF inflows have surpassed $137 million since mid-July. These fundamental strengths coincide with technical indicators suggesting a potential breakout, as SOL tests major resistance levels.

Institutional interest appears to be growing, evidenced by $137.4 million in net ETF inflows despite intermittent pauses. The July 24th single-day inflow of $13.4 million highlights sporadic but substantial demand. This accumulation pattern mirrors early-stage institutional adoption seen in more mature crypto products.

The convergence of robust fundamentals and technical positioning suggests Solana may be entering a new phase of market recognition. Should current trends persist, the $250 price target by September remains within plausible reach.

Hyperliquid Overtakes Solana in Blockchain Revenue Dominance

Hyperliquid has emerged as the dominant force in blockchain revenue, capturing 35% of the market in July and surpassing Solana. The platform's streamlined design and high-value user acquisition have driven a 360% year-to-date increase in open interest, reaching $15.6 billion.

VanEck's July report highlights a tectonic shift in market dynamics, with Solana losing ground to Hyperliquid's rising momentum. Traders are migrating en masse, drawn by Hyperliquid's balance of simplicity and robust functionality—a combination that now threatens Solana's historical valuation premium.

Saros Crypto Emerges as Solana-Based DeFi Liquidity Engine

Saros, a decentralized finance platform positioning itself as a 'New Generation Liquidity Engine,' is gaining attention for its all-in-one Web3 financial toolkit. Built on Solana's high-performance blockchain, the project aims to streamline decentralized trading and asset management.

The platform's focus on liquidity solutions comes as Solana continues to attract DeFi developers seeking alternatives to Ethereum's network congestion. Saros joins a growing ecosystem of Solana-based projects capitalizing on the blockchain's speed and low transaction costs.

Will SOL Price Hit 200?

SOL has a plausible path to $200 given its technical setup and bullish catalysts. Key factors include:

| Factor | Detail |

|---|---|

| Technical Resistance | $177 (current), $201.99 (Bollinger Upper Band) |

| Institutional Demand | Record-high inflows per news data |

| MACD Momentum | Bullish crossover with histogram at 7.6875 |

Robert from BTCC states, 'A September rally to $250 is possible if SOL holds above $177 and ETF inflows accelerate. The $200 target would require a 13% climb from current levels—achievable if Bitcoin remains stable.'

HTML table embedded in answer1 text